Australian housing markets have always shown a diverse

performance, and the most recent trend is no exception. While

the Sydney and Melbourne housing markets have recorded

a solid capital gain performance over the current cycle,

the Perth and Darwin markets have entered a down phase.

The remaining capital cities are generally showing a mixed

result of slight upwards or downwards movement across the

different product types.

Detached housing has generally outperformed apartments for capital

gain, but conversely, apartments are typically showing a healthier

yield profile compared with houses.

More recently though we have started to see some signs that

the housing market in Sydney, and to a lesser extent, Melbourne,

may be starting to move back towards a more sustainable pace

of growth. Dwelling values in Sydney have risen by close to 80%

since the beginning of 2009 and Melbourne values are almost 70%

higher. As such, a slowdown in the pace of capital gains shouldn’t

be a surprise. Auction clearance rates have fallen below 70%, on

high volumes across both cities. Sydney recently breached the 60%

clearance rate mark, as buyers start to regain some balance in the

market.

Rental rates are also recording relatively mild growth. Each of the

capital cities achieved only small rental increases or falling rents over

the past year. The highest rental growth has been in Sydney where

dwelling rents are up by 2.1%, while the most substantial falls were

are in Darwin, where the typical rent has fallen by 12.7% over the

year. The effect of soft to negative rental growth has seen lower rental

yields across each of the capital cities.

Housing market conditions are also being affected by changes in

the lending environment. In response to higher capital requirements

implemented by the prudential regulator, APRA, banks have lifted

mortgage rates by between 15 to 20 basis points across both owner-

occupier and investment. Mortgage rates for investment purposes

have seen an additional premium of approximately 30 basis points on

average.

The higher borrowing costs will be a disincentive to many prospective

buyers, particularly investors. However, despite this hike, mortgage

rates remain close to historic lows which should continue to support

housing demand.

Additionally, new housing supply has substantially increased over

the past three years, with the number of dwelling approvals recently

moving through a record high. The increased level of approved

housing supply is evident across both detached housing and

apartments. The substantial increase in dwelling approvals will carry

through to high levels of housing construction activity during 2016,

which in turn will provide a substantial boost to local economic

conditions.

Tighter lending conditions, more expensive mortgage rates for

investors and lower yields, together with natural affordability

constraints and higher levels of new housing supply is having a

culminating effect and moderating the pace of capital gains.

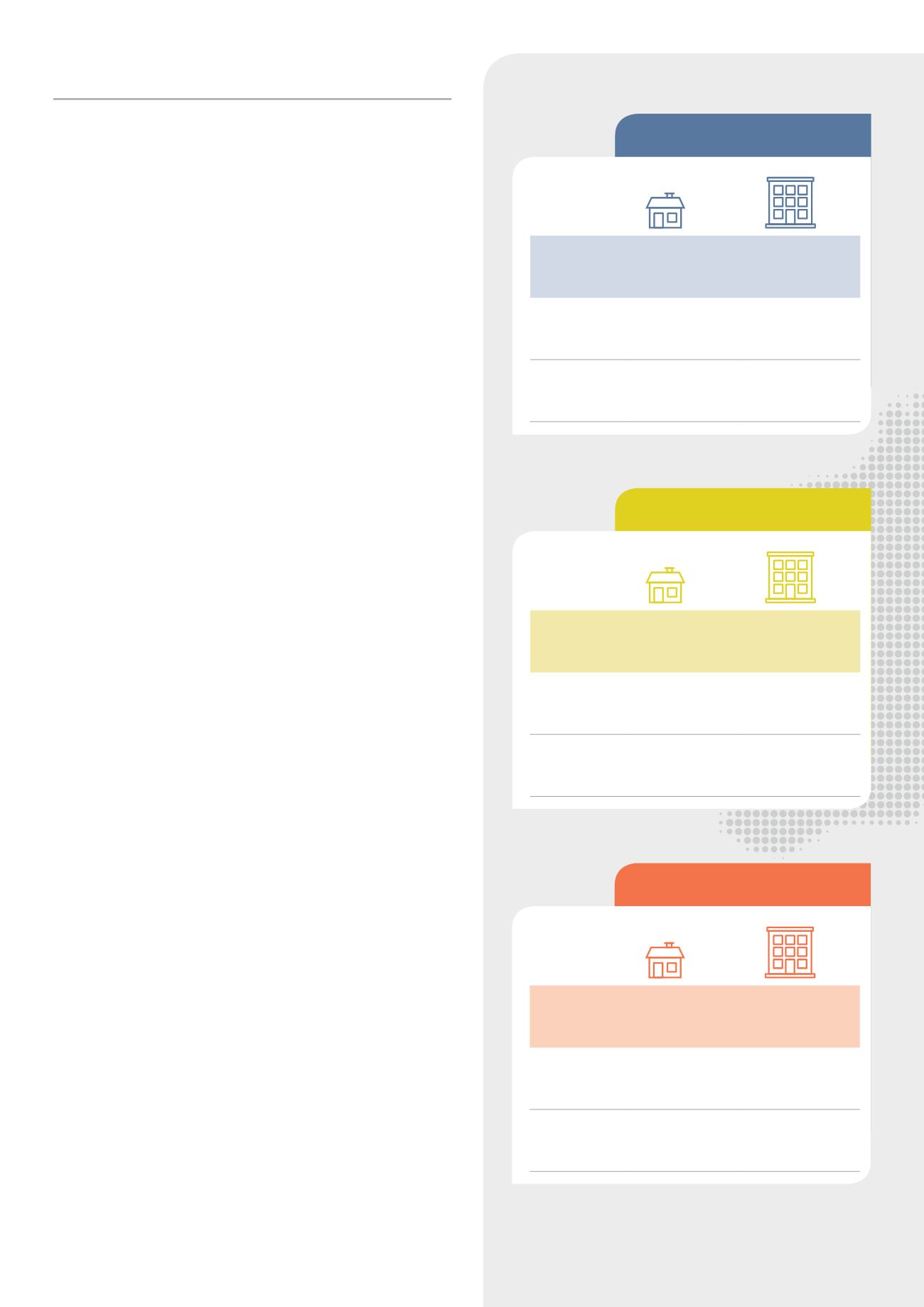

A tale of two markets

Note: ‘this year’ = September 2015, ‘last year’ = September 2014

* Based on postcode median house sale prices for 12 months to end September 2015.

Adelaide

Darwin

Houses

Units

Median Price

$430,000

$340,000

Growth

0.3%

-6.9%

Days on Market

48

this year

55

this year

56

last year

54

last year

Discounting

-5.6%

this year

-6.6%

this year

-5.7%

last year

-6.1%

last year

Houses

Units

Median Price

$590,000 $480,000

Growth

-3.1% -7.4%

Days on Market

81

this year

83

this year

55

last year

51

last year

Discounting

-8.3%

this year

-7.9%

this year

-4.7%

last year

-5.4%

last year

Perth

Houses

Units

Median Price

$520,000

$419,100

Growth

-0.7% -4.0%

Days on Market

72

this year

62

this year

46

last year

45

last year

Discounting

-7.3%

this year

-7.1%

this year

-5.0%

last year

-5.3%

last year

2